LMC Mortgage Investment Corporation

Canada's Growing Real Estate Investment Firm with Better Yields, Safer Returns

At Lendmax Capital Mortgage Investment Corporation, our goal is simple; Our investors get an excellent but consistently stable and safe return on their money. We do so by infusing technology, leveraging our decades of mortgage lending experience and a keeping a keen pulse on the real estate market.

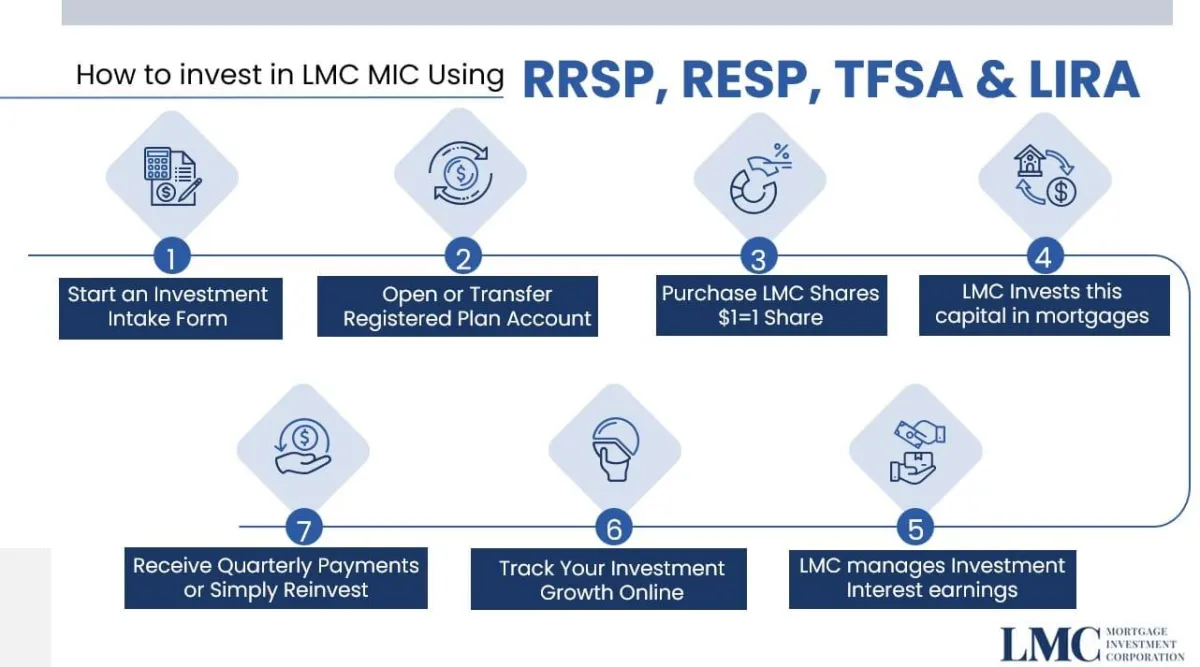

A Mortgage Investment Corporation, also known as a MIC is structured as a flow-through investment vehicle, allowing 100% of the net income to be distributed back to its shareholders. Under the Canada Income Tax Act, MIC investments can be held within a registered portfolio such as an RRSP, RESP, LIF, RRIF, LIRA, RDSP, IPP (individual pension plan), DPSP or TFSA. This means, you can use any of these vehicles to safely generate a reliable income.

Invest In Your Future Today & Earn up to 10% Yield

Our team has 30+ years in lending & real estate experience and we protect your investments like our own.

• We invest in Properties Only

• We only invest in First & Seconds

• We invest in Brick & Mortar

• We Accept Registered Accounts

• We Pay Quarterly Dividends

• Our DRIP is Quarterly Compounded

• Our Deal Pipeline is always full

• Our Investors Love our Returns

Our Core Team

30+ Years in Mortgage Lending, Canadian Real Estate and Fintech

Michele Squeo

Chief Executive Officer

Michelle Donaubauer

Director of Operations

Ankush Jaswal

Director of Technology

Kelly Mcbride

Director of Client Care

About LMC Mortgage Investment Corporation

With over 400 Mortgage investment corporations to choose from in Canada, what should you look for?

The LMC management boasts a 30+ years’ experience in mortgage lending, real estate and securities, this puts your investment at the forefront of opportunities. With a highly competitive lending rate we attract borrowers that are more stable and focused on exit strategies and we create loyalty with our brokers and borrowers alike to turn to us first for their next opportunity.

LMC operates a wide network of origination by offering In-house White-label products within trusted mortgage brokerages. This strategy has been successful in customizing solutions specific to the borrowers needs all while mitigating risk and working with mortgage agents on an exit plan.

LMC is the first of its business model to mesh the technology and borrower experience while paying a broker compensation on renewals on good standing active mortgages.

But that’s not why you should invest with LMC! Investments don’t happen overnight – Put a plan in motion today!

Invest with LMC to grow your money at up-to our 2025FY target of 11.00% and more on quarterly compounding on consistent and safer placements across Ontario. By expanding our service foot print province wide, we have become a reliable and trusted partner to brokers looking for a competitive rate for their clients observing lower loan-to-value and this delivers us the diversity to ensure consistently higher returns.

Investment Yield

Compare Our higher returns on lower risks. Under our Offering Memorandum, we aim to maintain 70 %to 80% or less on Portfolio Loan to Value which helps us during volatile markets and lets us offer up-to 85% during more stable periods. This flexibility helps us deliver one of the highest returns in the industry. Our projected returns for FY 2025 take into current housing marker, the lower property values and their adjustments over the past 2 years, while keeping a consistent return rate, our objective is to grow the portfolio size and further diversify our risk.

For 1st Mortgages rates starting at

7.99%

Target Rate

1st & 2nd Mortgages Bundles rates starting at

8.99%

Target Rate

2nd Mortgages & Helocs rates starting at

9.99%

Target Rate

We offer these competitive rates to borrowers so we get the best opportunities from rate sensitive clients with better credit, income and collaterals. Talk to an Investment Advisor to see how you can benefit from diversifying your portfolio into buckets of reduced risk and moderated risk thresholds.

Oversight of our operations with a board that guides us with their Lending, Investment, Real Estate and Accounting backgrounds.

Amitabh Chakrivarty

Board Member

Amitabh as an Ex- VP at SBI Canada helps LMC with policy creation, borrower vetting and due diligence processes. When Amitabh is not guiding us, he is an avid real estate investor with strong banking and finance background.

Vickie Zemelman

Board Member

A realtor and real estate investor by profession, Vickie brings an immense knowledge in real estate and helping us decide on what properties stand to be great investment opportunities. Vickie’s efforts have helped us achieve our proprietary property valuation model to help us deliver efficient underwriting to our clients and broker partners

Jahanzaib Khalid

Board Member

Jahanzaib is an active and practicing member of the upper law society and as a lawyer specializing in Real estate law, guides us through day to day transaction ensuring the safety and consistency in our lending operations.

Haskell Nussbaum

Board Member

Haskell practices law and specializes in Real Estate & Business Law, he also serves on our committee to help us with legal concerns around power of sale and enforcement law. Haskell has been pivotal in helping us build a safe and compliant lending practice that protects the investors in every angle

1

RRSP/LIRA

2

RESP

3

TFSA

4

Cash Savings

5

Corporations

Invest how you want, with absolute flexibility

With Registered Plan administrator Partnerships, you can put your money to work harder.

Invest for short term or long term commitments

Lendmax Capital Mortgage Investment Corporation’s Investment Strategy:

Lendmax Capital Mortgage investment Corporation has one main focus, to use its decades of experience in real estate and mortgage lending to help investors achieve a strong and consistent yield. We do so with a fusion of our extensive broker partner network and integrated proprietary technology that delivers a streamlined service to partners and borrowers alike.

Our investment approach is simple, we implemented Ontario wide funding to diversify our mortgage portfolio. There are great opportunities across the province and pockets where housing demand continues to stay strong. We also equally split our risk between first and second positions but we are diligently cap our risks with the market situation in mind. Post covid and thanks to inflation the housing market has been unpredictable, yet LMC has seen its’ best year since inception finishing off with a gross annual yield of 10.96% in FY2022. In just over 18 months of operations LMC has found a niche that aims at safer returns form lower loan-to-value investments with an solid exit strategy that continues to offer liquidity to perform even better. As LMC continues to grow, we invite investors to review our offering and talk to Investment Specialists to guide you better on how you can diversify your holdings through us.

The year 2020 – Months of preparation to get setup as a Mortgage Investment Corporation came with extensive due diligence and careful consideration of building the right team to lead and guide our investment objectives. We completed all our paperwork and were on our way to becoming a mortgage investment corporation in the new year!

The year 2021- As we filed our offering with OSC, we were almost immediately greeted with Covid shutdowns and a very unpredictable market. We continued our humble operations to grow the fund while acquiring investments under our friends and family exception. As a first year for the mortgage investment corporation, we equipped ourselves with the ability to accept registered investments and partnered up with Community Trust and Western Pacific Trust Company.

Our first closing in August of 2023 let us start our lending operations and fund our very first deal, since then we haven’t looked back.

The year 2022- With full fledged operations we focused on creating infrastructure, a scalable technology while investing in every sound mortgage investment opportunity as we built a book of business and connected with our broker partners to find the perfect place for our product offering. We quickly became the challenger lender offering 1st and 2nd mortgages to quick close and short term mortgage needs. With minimal investment intake we finished the FY2022 with a strong gross earning of 10.96% annual yield and where other MIC’s continue to offer a return hovering around 6-7% after decade worth of operations, we humbly paid out 7.82% Annual Net Return to all our investors. Our 2023 annual earnings landed us a net dividend paid at 8.42%, & 2024 we finished off with a 10.15% paid to investors.

So, if you are looking for an investment opportunity that targets growth, safe and consistent returns, be sure to compare our fresh take to a lean business model on path to becoming a big name in Canadian Mortgage Lending & Investments. Learn more from a licensed Exempt Market Dealing Representative today!

Securities Offered

Class A Preferred Shares

Class B Preferred Shares

Class R Preferred Shares

Auditor

YALE PGC LLP

Legal

Mixa Law

Eligibility

Accredited Investor & Offering Memorandum Exemption

Trustee

Olympia Trust Company

Western Pacific Trust Company

Exempt Market Dealer (EMD)

Startly Capital

Taxation to Shareholders

Distributions are considered interest income &

T5 are issued

Offering Size

Up to $5,000,000

Unit Price

$1.00 / share

Minimum Investment

$5,000.00; compounded DRIP available

2021 Annual yield : 6.00%

2022 Annual yield : 7.82%

2023 Annual yield : 8.42%

2024 Annual yield : 10.15%

2025 Annual Target Yield : 11.00% Releasing in March, 2026

Accepted Accounts

CASH, RRSP, TFSA, RRIF, LIRA, FHBA, CORPORATION

Redemption

Anytime after 1 year (60 day notice required)**

Closing Date

1st business day of each month

* There are no assurances that target returns will be met

** Early redemptions are subject to fees – refer to our Offering Memorandum for more information

DISCLAIMER: The information provided on this website does not constitute an offering of securities and cannot be relied upon for making your investment decision. An investment may not be suitable for all investors or portfolios. Before investing, please read the Corporation’s Subscription Agreement and Offering Memorandum, including risk factors. You should not take any action with respect to any securities mentioned herein without first consulting your own Advisor in order to ascertain whether the securities mentioned are suitable to your particular circumstances. This information is not a substitute for obtaining professional advice. The information contained herein has been obtained from sources believed to be reliable at the time obtained; however, neither LMC Mortgage Investment Corporation nor its affiliates, employees, agents, or information suppliers, can guarantee the information’s accuracy or completeness. Results are not guaranteed; values change frequently, past performance may not be repeated, and investors may experience a gain or a loss. Monthly distributions are not guaranteed – distributions will be adjusted from time to time, and may include income subject to current taxation for non-registered accounts. This material is not intended to be or constitute tax or legal advice – consult your own tax and legal professionals. Said material and any commentary are subject to change without notice and is provided in good faith, but without legal responsibility.

Increase Your Earnings with LMC - 2025 Target Annual Dividends 11.00%

LMC Mortgage Investment Corporation is dedicated to offering a competitive rate to its borrowers with an efficient and quick turnaround. This is what gives us the edge of returning clients and ability to churn the mortgage multiple times within a single year. The additional revenue supports our portfolio growth in yield offering as well as the size of the portfolio.

Are you looking for reliable investment vehicles that can generate high returns and a steady..

Investing in mortgage investments can be a savvy way to diversify your portfolio and earn more significant..

Lower LTV borrowers across Ontario benefit from competitive rates and a conservative Risk approach for..

Quick Access to funds for short term needs with an evident exit strategy protects investors from long term risk

Higher Returns upto 11% mitigated by property, servicability or cross collateral, these products come with..

LMC Mortgage Investment Corporation is carefully managed by a team of experts in the finance, real estate and mortgage lending space. With 30+ years backing the management you can be sure that your investment is in safe hands.

Our 3 Step Investment Approach

We have narrowed it down to a science, with our own money invested into the mortgage corporation, we know what it takes to protect yours!

01

Risk Analysis and

Mitigation

02

Safe and Consistent Higher Yield Returns

03

Proprietary Underwriting and Due Dilingence

We deliver consistent returns with every single mortgage placement being carefully evaluated for cash flow, exit strategy and a short term liquidity solution.

Consistent Returns, Higher Yields

We mastered a process. Where others are running the business on an excel sheet, we integrated technology from the investment intake to the borrowers funding! A digital trail on every dollar means accountability for every dollar spent well.

Diversified Portfolio

Hands Free Investing

Strong Risk Mitigation

2024 Target Yield 10.00%

Why Invest with LMC?

There is more to an investment than just it's placement. At LMC we start with an avoidance strategy, to ensure our capital is applied against the best of the best opportunities we grade each transaction before funding and carefully strategize a Plan B for every mortgage funded. Learn how we put technology to use to protect your money and generate some of the highest industry returns.

Interested in investing, check out our Frequently Asked Questions

Interested in investing, check out our frequently asked questions ?

Our mortgages are offered in the form of a first and second position charge upto a maximum Loan-to-Value of 85%, however in market with high volatility we observe a lower risk and max out between 70-75% LTV. We strictly lend on residential properties across Ontario with a minimum population size of 25,000 or more. Most of our mortgage placements are well situated close to larger towns and cities and suburban areas in Ontario

How does LMC MIC find mortgage borrowers?

Our lending model is available for direct consumers and our loyal mortgage broker community across Ontario. We focus on clients through our broker channel to maintain business continuity.

How is the mortgage market regulated?

LMC MIC is a mortgage investment corporation operating under section 130.1 of the Income Tax Act (Canada) (the “Act”) where investors categorized under non-qualified, qualified and accredited can opt to invest and purchase shares of the company that generates a revenue from lending against properties. The investment intake process is managed under an exemption within private markets under the regulation of OSC (Ontario Securities Commission) and each investment is vetted by an EMD (Exempt Market Dealer). The mortgage funding management is facilitated by Lendmax Inc. that operates under the regulation of FSRAO (Financial Services Regulatory Authority Ontario) to ensure accurate mortgage payment, arrears and funding administration.

What are the benefits of MIC investing?

1. Canadian Residential Real Estate strength derives from our community holding a priority over payments towards a shelter in high regard. This allows a MIC to invest into the real estate where over decades we have seen a consistent incline and appreciation of property values. As a MIC shares sold to investors raise capital to lend mortgages to borrowers under a strict criteria of qualification that offers a pre-meditated return on the loan advanced. This is an amazing solution to increasing cashflow to your portfolio.2. RRSP / RESP / TFSA / LIRA Eligibility to invest in a MIC compares to other products that may be invested under these vehicles. Registered accounts of these nature are a great way to reduce or remove tax liabilities in growth of your principal amount. Holding and managing your self-directed RRSP or RRIF accounts is easy.3. Competitive Returns: Put your money to use by yielding above 7% in consistent and stable dividends, using the MIC investment model, you are investing in a brick & mortar opportunity that has been carefully vetted by the MIC management as a promising return.4. Professional Management: An experienced team that manages your money by utilizing their expertise in mortgage lending, real estate, property acquisitions and financing can help you generate safer returns on your investment.5. Diversification: Today’s market volatility demands a modest approach in hedging risks elsewhere, by investing in a MIC, a stable and consistent return you can reduce your exposure to the market and losses.

What risks are associated with investing in a MIC?

Although real estate investing is considered one of the safest investments, risks still exist in mortgage lending. All property investments are subject to elements of risk. Property value is affected by general economic conditions, local real estate markets, the attractiveness of the property to tenants, competition from other available properties and other factors. While independent appraisals are required before the corporation may make any mortgage investment, the appraised values provided therein, even where reported on an “as is” basis, are not necessarily always reflective of the market value of the underlying property, which may fluctuate. The MICs’ income and funds available for distribution to security holders would be adversely affected if a significant number of borrowers were unable to pay their obligations. Upon default by a borrower, LMC MIC may experience delays in enforcing its’ rights as lender and could incur costs in protecting its investment. To mitigate these risks, the experienced team of Underwriters at LMC MIC carefully review every application to reduce the possibility of non-performing loans. Furthermore, strict loan to value guidelines and a proactive approach to collections ensure enough equity is available to recover outstanding loan balances in case of foreclosure.

Is my money locked in? What happens if I die or I need the money?

LMC MIC has a 12 month redemption period which commences from the month end of initial subscription. After the redemption period expires, an investor can withdraw their funds simply by advising us in writing so that a redemption notice received will be effective within 15 days of the end of the quarter following the quarter in which the redemption request is received. We also have a compassionate early redemption and death of shareholder policy which allows a surviving spouse to have the investment redeemed earlier than the normal maturity date. Please refer to Offering Memorandum for further detail.

How am I taxed?

For income tax purposes, the returns that our investors receive are treated as interest, not as dividends.

How do I invest funds from my RRSP, TFSA or RRIF in LMC MIC?

Investing using your registered accounts is easy, with our Partnerships with Plan Administrators like Olympia Trust and Western Pacific, we can assist with account opening and help facilitate your fund transfer requests.

How do I receive my interest?

Our investors can choose to take advantage of our automatic dividend reinvestment plan (DRIP) and gain the benefit of compounding their return. Alternatively our investors can receive their monthly dividends by direct deposit to a specified account.

Is the investment guaranteed?

No. Our underlying security is the Canadian real estate property against which we have mortgage charges and, in most cases, the personal guarantees of the owners of the property.

Who do you lend to?

LMC MIC focuses on residential properties in urban and suburban areas in Ontario that are highly marketable. LMC MIC’s clients are mostly self-employed, new immigrants and borrowers with soft, poor or no credit. We mitigate the risk with our proprietary underwriting model.

What is the size of the market?

The residential mortgage market surpassed $1.3 trillion dollars in 2016. It has been growing at an annual growth rate of 7% compounded every year for the last 10 years. The Banks and Trust Companies focus on the 80% of the market. Due to tighter restrictions by the regulators the Banks and Trust Companies have restricted their lending practices. This has created a larger opportunity for LMC.

A Risk Threshold For Every Investor

Brick and Mortar. Invest in LMC knowing we have an active and hands-on asset management team with years of experience to suit every investor risk bucket. We believe we provide better alternatives to banks and other investment advisors with a minimum investment starting at just $5000 in cash or a registered vehicle of your choice, all of this with $0 Management Fees.